Long Term Care

A WORD OF CAUTION…. Long-term care planning requires in depth knowledge of tax law, proficiency in estate planning, and a thorough understanding of the Medicaid laws and regulations which are constantly updated and changing. Long-term care estate planning and Medicaid planning should only be done under the supervision of an Attorney with specific knowledge in the areas of Elder Law and Medicaid rules and regulations. Certain transfers and modifications of assets can have significant tax ramifications that should be discussed with your attorney. Furthermore, improper transfers or gifts can disqualify a Medicaid beneficiary, result in a significant period of ineligibility for Medicaid benefits, and even future Medicaid recovery efforts.

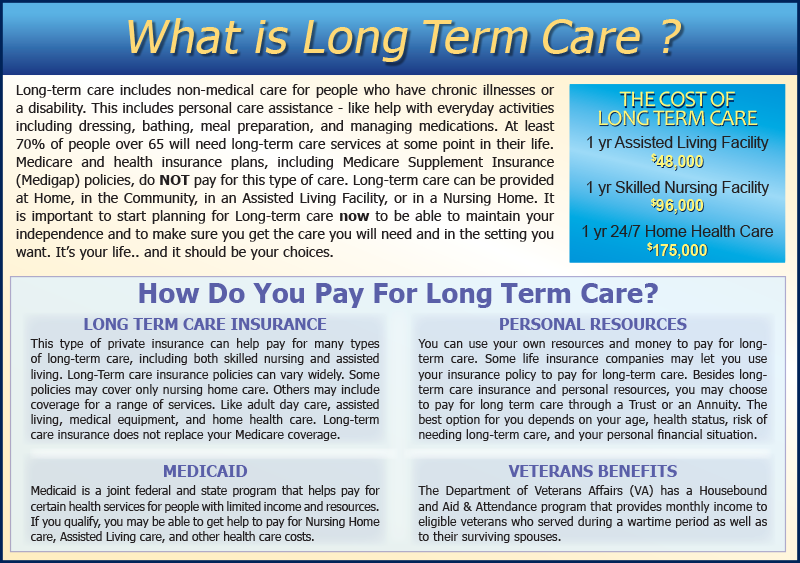

WHAT IS LONG TERM CARE?

Many people think the phrase “long-term care” refers to an insurance policy. While insurance may be part of your strategy, long-term care encompasses everything from your future medical care and finances, to where you will live and how you will navigate the myriad of legal, family, and social dynamics along the way.

Most people over 65 will need some kind of medical and/or personal care for months or years because of a health issue or the natural decline of eyesight, hearing, strength, balance and mobility that comes with aging. Your path will be unique to you, and based on your preferences and circumstances. Let’s look at the basic questions covered in this section:

- What is long-term care?

- Who needs care?

- How much care will you need?

- Who will provide your care?

- Where can you receive care?

- Who pays for long-term care?

Life Planning Law Firm, P.A. assists seniors and their families in maximizing their quality of life and independence now through our Life Care Planning services which bundles asset protection, public benefits qualification, care coordination, nursing home connection (matching clients to the senior communities or home health care service companies that befit their specific needs, wants and budget), and crisis intervention services — all in one convenient service package.

“How can I preserve my assets and not go broke paying for long term care?”

“Will I be able to live at home as long as possible?”

“There are so many care facilities. How do I know which one is best for me?”

“Is it still possible for me to get help from Medicaid or the V.A. Aid

and Attendance program if my net worth is a little too high to qualify?”

“Are there any community resources available to help me?”

“Who will coordinate all these things so I can be sure to get long term care?”

Our program comprises:

- Matching you with the right care setting

- Determining the right care for you

- Helping with eligibility for Medicaid and also V.A. benefits for the veteran or the veteran’s family

- Preparation of Living Trusts and other legal documents to help protect your home and assets

- Monitoring services during your life so we can have fast response and arrange for any additional legal or financial means you may need to avoid any disruption in care

- Senior advocacy and communication with health care professionals, your family and others who are involved or directly assisting with your care and wellbeing.

Obtaining good long term care and figuring out how it can be paid for is a daunting task for most seniors and their families. Our long term care services allow you and loved ones to rest easy knowing you will be able to obtain and comfortably transition to a life that includes care that’s right for you.

LONG TERM CARE CALCULATOR

https://www.genworth.com/corporate/about-genworth/industry-expertise/cost-of-care.html

Find out how much long term care costs in your state.